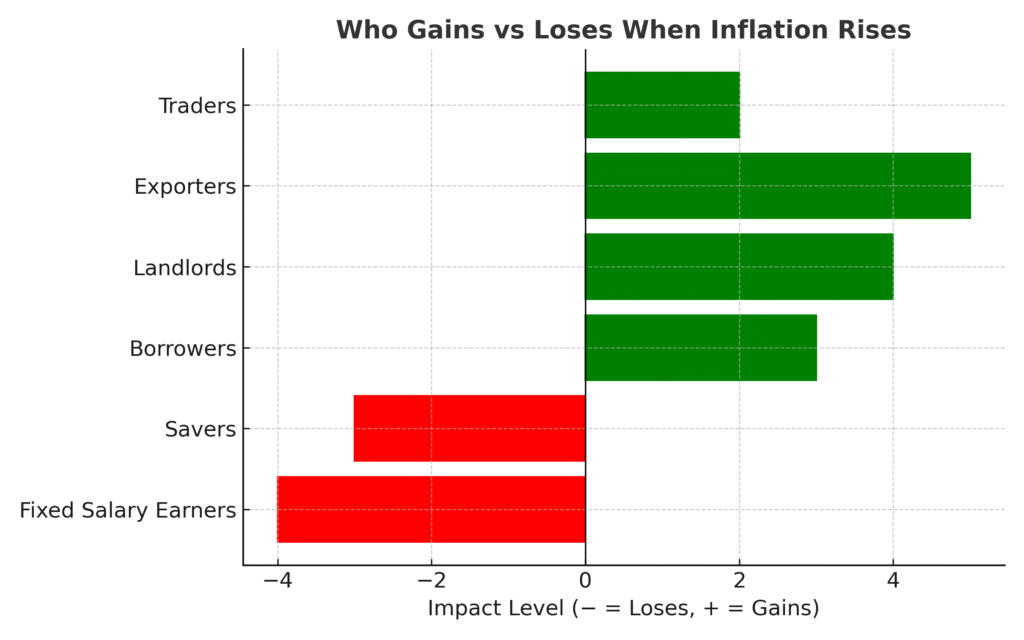

Inflation doesn’t hit everyone the same way. While one person is complaining that things are “too expensive,” another quietly smiles because their property, farm, or business is suddenly worth more. Understanding who gains and who loses from inflation helps reveal these contrasting impacts.

Unusual, isn’t it? Let’s break it down step by step in the second installment of our “Inflation and Your Money” series.

Inflation Isn’t the Same for Everyone

Imagine two friends, Musa and Tola.

Musa works as a civil servant earning ₦400,000 monthly. He’s disciplined, saves ₦50,000 every month in a bank account that pays 5% interest per year.

Tola, on the other hand, is a small landlord who collects ₦400,000 per year in rent for a mini-flat. Last year, he raised the rent to ₦600,000 because, well, “cement has gone up.”

Guess what? Both are feeling inflation — but in very different ways.

While Musa’s salary buys fewer groceries and his savings lose value daily, Tola’s property appreciates, and his rent goes up with prices. That’s inflation in real life: it creates winners and losers.

The Losers: Salary Earners and Savers

If you earn a fixed income, you’ve probably noticed this already — your salary doesn’t stretch like it used to.

When inflation rises but your pay doesn’t, your purchasing power (the amount your money can buy) falls. That’s why ₦20,000 worth of groceries from 2022 barely fills one bag today.

Here’s how it plays out in Nigeria:

- Civil servants still earning the same pay from years ago now spend twice as much on food, rent, and transport.

- Private employees who rely on monthly salaries suffer when companies fail to adjust wages for inflation.

- Savers who keep money in the bank at 5% annual interest lose out when inflation sits at 25%. That means your money is shrinking by 20% every year — quietly, invisibly.

Even pensioners on fixed retirement payments struggle because their monthly stipends can no longer cover essential needs.

Inflation punishes people who sit still.

The Winners: Borrowers, Landlords, and Business Owners

Here’s the funny part — inflation also rewards some people.

- Borrowers win when they repay loans with money that’s now worth less. If you took a ₦1 million loan at a fixed interest rate last year, you’re technically paying it back with cheaper naira today.

- Landlords and property owners raise rent and watch their property values soar. Inflation increases the cost of building materials, so existing assets gain value.

- Exporters and business owners who adjust prices quickly or sell goods in foreign currency often stay ahead of the curve.

For instance, farmers selling palm oil or cassava to regional markets often earn more during inflationary times — because food prices rise faster than most other things.

So while inflation hurts consumers, it often boosts the profits of those who produce or own.

Why Businesses Change Prices (and Why You Feel It at the Supermarket)

Think of a sachet of milk that used to cost ₦80 but now goes for ₦150. Did the milk suddenly become “luxury”? No — the producer is responding to higher costs.

Businesses raise prices because:

- Import costs rise when the naira weakens against the dollar.

- Transport and energy expenses increase with fuel price hikes.

- Raw materials cost more, and everyone along the supply chain adjusts to survive.

This ripple effect is called “cost-push inflation”, and Nigeria is a classic case of it right now.

Every time you complain at the supermarket, remember: the inflation you see on shelves began long before it reached your cart.

The Nigerian Twist: Shrinkflation and Policy Shocks

There’s another sneaky player in the mix — shrinkflation.

That’s when you buy your favourite biscuit, peanuts or detergent at the same price but notice it’s smaller or contains less. The manufacturer doesn’t “raise” the price; they quietly reduce the quantity.

Then there’s fuel subsidy removal and exchange rate unification, both of which Nigeria has experienced recently. These government policies, while necessary for long-term economic balance, create short-term inflation spikes.

Businesses pay more for imports, transporters raise fares, food prices rise — and everyday people feel the squeeze.

Real-Life Story: Musa vs. Tola

Let’s return to Musa and Tola.

Musa’s rent went from ₦450,000 to ₦600,000 this year. His children’s school fees also increased, and his monthly ₦400,000 salary now barely lasts three weeks.

Meanwhile, Tola (his landlord) is smiling. Not only did he increase the rent, but the value of his property has doubled on paper. His mortgage? Fixed rate. His debt didn’t inflate. His assets did.

Both men are playing in the same economy, but one is losing purchasing power while the other is gaining asset value.

Inflation is neutral. It just depends on what side of the fence you’re standing on.

FINTEL Action Step: Run an Empathy Audit

Here’s a simple exercise for you:

Take a notebook and list out the following under two columns —

Column A: Things inflation hurts

(e.g., salary, bank savings, fixed income)

Column B: Things inflation helps

(e.g., property, business assets, rent, investments)

Now, ask yourself: Where do I stand?

If your money is mostly sitting in Column A, it’s time to make a shift — learn, earn, and invest smarter.

👉 You can start by testing out the Inflation Calculator in our FinTools section to see how much purchasing power you’ve lost — and what to do about it.

Then, join our FINTEL Warriors Community, where we’re learning how to build assets, hedge against inflation, and grow income faster than prices rise.

Final Thoughts

Inflation creates a divide — between those who understand money and those who ignore it.

The truth is, you don’t need a finance degree to win this game. You just need awareness, the right information, and the courage to act.

Next in this series, we’ll talk about “Beating Inflation: How to Protect and Grow Your Money in 2025.”

That’s where you’ll learn practical steps to invest, diversify income, and stay ahead — no matter what the economy throws your way.

Subscribe to my newsletter and be the first to know when I publish a new post!

Pingback: Inflation and Your Money: How Inflation Affects Nigerians in 2025 - FintelCoach

Pingback: How to Beat Inflation in Nigeria: Smart Money Moves for 2025 - FintelCoach