Emeka was tired.

Every month told the same story. Salary in and salary out before the next paycheck.

Rent, fuel, groceries, data, and somehow, nothing left to show for all his hard work.

Emeka is a 34-year-old Chartered Accountant working at a private firm and earns ₦350,000 monthly. It wasn’t a bad income on paper, but with just one source of livelihood, it always seemed to vanish too quickly.

He wasn’t reckless. He didn’t live extravagantly. In fact, he prided himself on being responsible. He budgeted, avoided debt, and faithfully followed the golden rule of living within your means.

Yet, his “means” kept shrinking.

One evening, after paying for fuel that had tripled in price, Emeka sighed and thought, “So this is it? Just working to survive?”

That’s when it hit him that maybe the problem wasn’t that he wasn’t disciplined enough.

Maybe it was that the rule he had been living by was no longer enough.

Maybe it was time to stop living within your means and start learning how to expand them.

What Does “Living Within Your Means” Really Mean?

At its core, living within your means means your monthly spending does not exceed your monthly income.

On paper, it sounds wise. After all, how can you spend what you don’t have? For decades, this philosophy has been passed down as the golden rule of financial discipline.

But the problem is, your “means” are shrinking every day.

Inflation rises, salaries stay flat, and life keeps getting more expensive. If your income remains the same while the cost of everything else goes up, how long can you keep “living within” that shrinking boundary?

That’s why this advice can quietly become a trap.

Why “Living Within Your Means” No Longer Works

1. Your Means Are Shrinking Daily

What your ₦100,000 could buy two years ago is not what it can buy today. Things are changing, prices are increasing, and most people’s earnings are not catching up.

When this happens, people begin to trim their budget to the bare minimum until there’s nothing left to trim. But the real problem is that your means no longer meet your needs.

If your income doesn’t grow alongside inflation, it will limit your capacity, and you’ll begin to shrink to cope.

2. It Breeds a Scarcity Mindset

When all you think about is “staying within your means,” you begin to see life through the lens of lack.

You stop asking, “How can I afford this?” and start saying, “I can’t afford this.”

Scarcity thinking is dangerous.

It kills creativity. It replaces ambition with anxiety.

And before long, you find yourself envying those who seem to “have more,” instead of exploring how to create more.

3. It Silently Kills Your Vision

Many people give up on their dreams simply because they can’t see how to finance them.

They rule out opportunities that could change their lives, like business trips, investments, education, all because those things seem “above their means.”

The reality is that vision always precedes provision.

The resources you need often show up after you decide to stretch beyond your comfort zone.

If you only live by what you currently earn, you’ll never grow into what you’re truly capable of becoming.

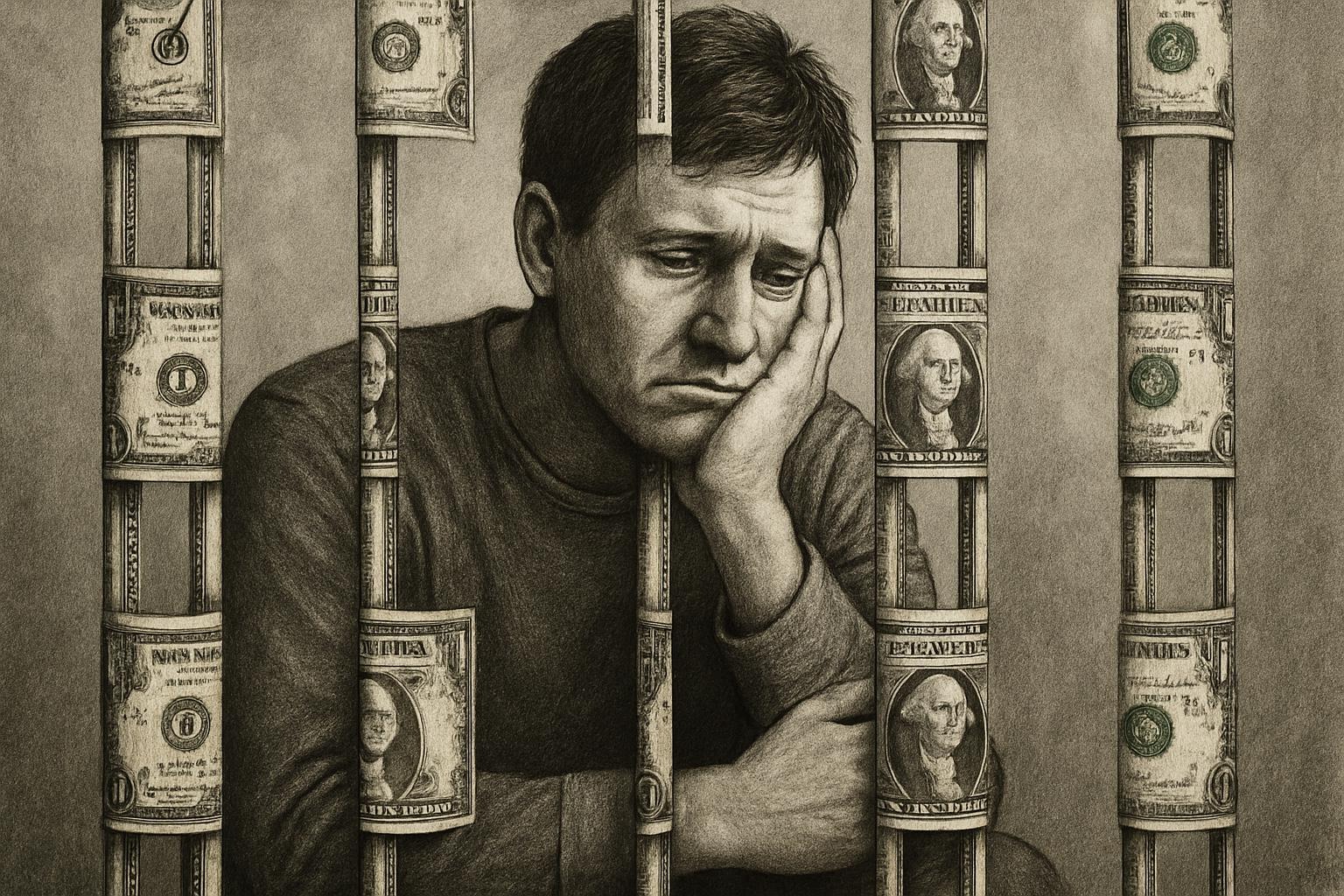

4. It Keeps You Trapped in Victim Mode

Ever met someone who says, “Do I have a choice?” when you ask why they stay at a job they hate?

That’s what happens when people live strictly within their means.

They stop negotiating for better pay, stop upskilling, stop reaching for more.

They become a shadow of their former selves and prisoners of their paycheck, because they’ve been conditioned to manage rather than multiply.

5. It Makes Life Boring

Financial discipline is good, but not when it strips your life of joy and adventure.

If “living within your means” keeps you from taking care of your health, treating your family, or enjoying simple pleasures like travel or hobbies, then it’s not wisdom.

You deserve a life that feels alive, not one that’s perpetually cautious.

The FINTEL Way: Expand Your Means

If “living within your means” limits you, then the antidote is simple — expand your means.

This doesn’t mean reckless spending or piling up bad debt. It means growing your capacity to earn, create, and attract more value so your lifestyle aligns with your vision.

Here’s how to start.

1. Adopt an Abundance Mindset

Everything begins with mindset.

An abundance mindset believes there’s enough opportunity, wealth, and success for everyone, and you’re not an exception.

When you embrace an abundance mindset, your salary is not a limit but a starting point. It becomes a seed for growth rather than just a means to survive. Shift your thinking from mere survival to expansion, and free yourself from the constraints of “living within your means.”

Instead of saying, “I can’t afford that,” ask, “What can I do to afford that?”

This one question can change your entire financial direction.

2. Invest in Yourself

Expanding your means starts from expanding your capacity.

Build your skills, upgrade your knowledge, and position yourself for higher income.

Take online courses. Learn a digital skill. Attend workshops.

Your earning potential grows every time you grow.

You are your first and most important investment, especially when it comes to expanding your means.

3. Boost Your Income Streams

Don’t rely on one paycheck to carry all your dreams.

Create multiple streams of income, side hustles, consulting, freelancing, small businesses, or digital opportunities.

If your salary covers your bills but not your vision, find ways to earn an extra 20–30%. That extra income can fund your future.

4. Build an Emergency Fund

Life happens. Cars break down, people fall sick, unexpected expenses arise.

An emergency fund (3–6 months of living expenses) protects you from panic borrowing or financial collapse.

It’s not a luxury. It’s a safety net that gives you peace of mind while you build wealth.

5. Save and Invest Intentionally

Saving money is good, but it’s not enough.

Your savings should have a purpose, either to invest, start something new, or fund a goal.

Set aside a fixed percentage of your income every month and put it to work in vehicles that beat inflation: mutual funds, equities, T-bills, or fintech platforms like PiggyVest or Cowrywise.

You can’t expand your means by hoarding. You expand them by putting money where it can grow.

6. Leverage Opportunities Wisely

When you’ve built financial discipline and confidence, learn to leverage resources like other people’s money, partnerships, or networks, to achieve bigger goals.

That’s how businesses grow and how ordinary people make extraordinary moves.

Leverage isn’t greed; it’s strategic growth when done with knowledge and caution.

FINTEL Action Step

Take 10 minutes this week to list three areas of your life where you’ve been “playing small” because of your means.

For each, write one bold step you can take this month to expand, it could be learning a new skill, pitching a new client, or saving for an investment.

Then, go a step further and use the FINTEL Freedom Engine, one of our tools designed to help you see your financial future clearly. Simply put in your income, expenses, savings, and “freedom number,” and watch your Freedom Date and wealth growth appear in real time, complete with an interactive chart you can drag and explore.

It’s one of the simplest, yet most eye-opening ways to understand where you stand today and how fast you can reach financial freedom.

Final Thoughts

Living within your means is good advice for survival.

But if you’re ready to thrive, it’s time to outgrow that mindset.

Your “means” should never define your destiny. Expand them. Stretch them. Multiply them.

Because financial freedom is about discovering what’s possible.

Pingback: How to Build Multiple Streams of Income: The Complete Beginner's Guide - FintelCoach