I bet you’ve heard the famous “you need to make money while you sleep” line. Sounds glamorous, but risks sounding like an ‘aspire to retire,’ lazy idea.

However, the idea is not bad. It’s just often misunderstood. Making money in your sleep doesn’t mean you are lazy or unserious. It means you want your money to work as hard as you do. That’s passive income.

Let’s unpack passive and active income in plain language.

Active income

This one is pretty straightforward. You earn because you show up. You put in your time and your skills, and money comes out the other end.

It can come from:

- Video Editing Freelancing

- Your daily 9 to 5 salary

- That perfume business

Active income is the fuel that powers every other income stream you want to build. Most people start here and that’s perfectly fine. But it shouldn’t end here.

Passive income

This is the dream. Passive income is money that comes because of what you already did, not necessarily what you’re doing right now.

Think of planting maize. You dig the soil, plant, water and weed. You sweat it out at the beginning. Then one day it grows whether you show up or not. That’s passive income. You do the groundwork now so you can enjoy the harvest later.

It shows up as:

- Stocks from shares of a company

- Royalties from a book or online course

- Rent from property

Passive income doesn’t mean “lazy income.” It means “smart income.” You still work, but you work upfront. (Repeated for emphasis).

And you don’t need millions to start. You just need consistency and patience.

P.S.: If anyone promises you quick passive income with zero effort and guaranteed returns, look for the nearest exit. If it sounds too good to be true, it usually is.

How Combining Active and Passive Income Helps You Earn More

Let’s look at a real-life example.

Ike is a regular 9–to–5 guy. He earns 250k monthly from his job. Pretty decent and pays the bills.

Last year, he learned how to create digital templates for social media managers and uploaded them on Selar.

Two months later, he ran ads, and people across Africa and the diaspora started buying it. On some days, he woke up to 12 sales. Some days 3. Some days 0. The money trickled in consistently.

This is how building multiple streams of income really starts.

Get started with these:

- Earn from your skills

- Start investing

- Reinvest the returns

- Grow your portfolio patiently and consistently.

Bottom Line

Balancing active and passive income streams is important to financial security. Active income requires time and effort, while passive income generates earnings from investments or systems you’ve set up. Tailoring your strategy to your financial goals and resources ensures you maximize both income sources effectively

FAQ

Q: How long does it take to start earning passive income?

A: The time varies depending on the method chosen. For example, rental properties or investments in dividend stocks might take months to set up, while a blog or digital product may take longer to gain traction but can eventually generate income with minimal upkeep.

Q: Can passive income replace active income entirely?

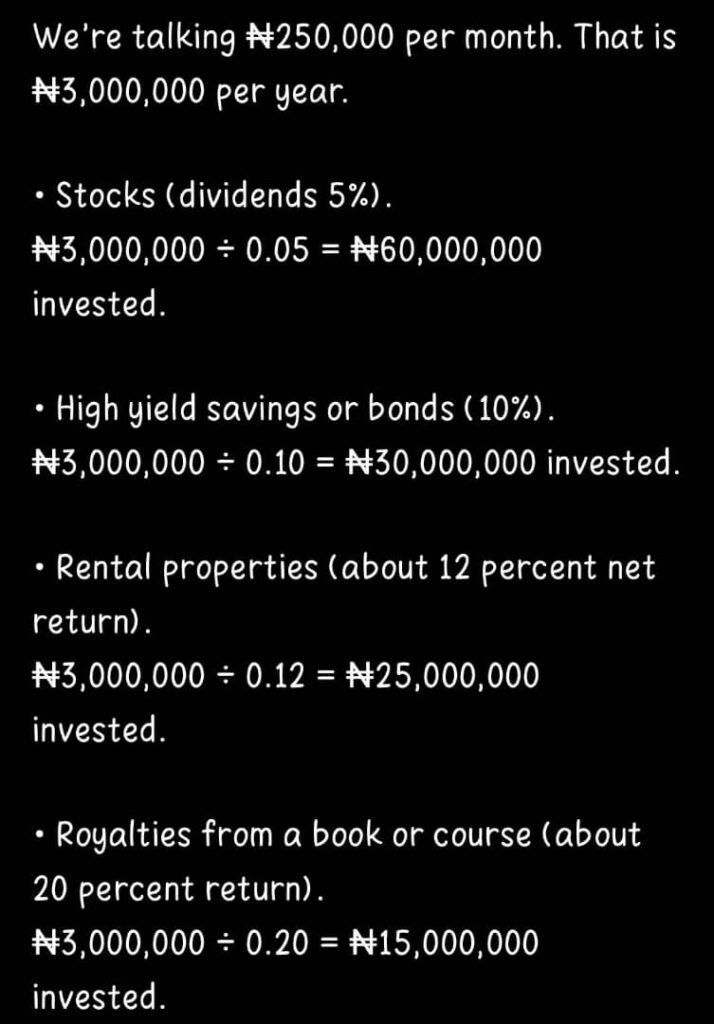

A: In theory, passive income can replace active income entirely, but it typically requires significant time and effort to build up a solid portfolio of passive income streams. Practically, to gain returns of ₦250,000 (average income)from investments, here’s the math (approximately)…

This is not to scare you, but to make sure you understand that earning passive income means playing a long game.

Q: What are the risks of passive income?

A: Passive income can be a stable source of revenue, it still carries risks. For example, rental properties may incur maintenance costs or experience vacancy periods, while dividend stocks can be impacted by market fluctuations. Spreading your money across different investments and keeping an eagle eye on them can help lower the risks.

Q: Should I even bother with passive income?

A: Yes. Please. Absolutely.

Q: When should you start thinking about passive income?

People sometimes think passive income is for unserious people or people avoiding real work. This is not true. Passive income requires skills, knowledge and strategy. It’s a smarter path because it breaks the “time for money” trap. You only have 24 hours. And you need to sleep in some of them. Your money doesn’t need sleep nor time.

A: Short answer: As early as possible.

Longer answer: Once you have a stable income and you’re building your emergency fund, you can start investing. You don’t have to complete the entire emergency fund before starting. Just get a good balance so when emergencies come, you don’t rush to use your returns.

If you want to start building other streams of income and need help picking investments or finding the stream of income best suited to you, consider speaking with a financial advisor.

Pingback: How to Build Multiple Streams of Income: The Complete Beginner's Guide - FintelCoach