For most professionals in Nigeria, the end of the month is a bittersweet ritual. There’s the notification ping from your bank, the “alert” we all live for, and then there’s the quiet, slightly confusing look at the pay slip. You see a line item labeled PAYE, a five or six-figure deduction, and you simply shrug.

“It is what it is,” you tell yourself. You trust that HR knows what they’re doing. You trust that the payroll software is updated. Maybe, you assume that because the deduction is automatic, it must be accurate.

But here’s a grounded, slightly uncomfortable truth:

Trusting the system without understanding the system is how you quietly leak wealth.

In the wake of the Nigeria Tax Act 2026, the “set it and forget it” approach to your salary is no longer just passive. It’s expensive. Tax isn’t just a monthly inconvenience; it is a variable in your financial system that, if left unmanaged, behaves like a slow puncture in a tire. You’ll still reach your destination, but you’ll burn way more fuel than necessary getting there.

Let’s pull back the curtain on the “black box” of payroll and talk about why transparency is the ultimate form of financial leverage.

The Myth of the ‘Correct’ Payslip

We live in a culture that treats tax like a “mysterious force of nature.” We think of it like the weather, something that happens to us, rather than something we can navigate. Most salary earners believe that as long as they aren’t “dodging” taxes, they are doing fine.

But there is a massive difference between Tax Evasion (illegal) and Tax Optimization (smart).

When you don’t understand how your tax is calculated, you aren’t just being a “good citizen”; you are operating in the dark. According to recent insights from the Nigeria Revenue Service (NRS), the push toward a more digital and streamlined tax process is meant to increase compliance, but the burden of claiming reliefs still often falls on the individual. If you don’t know what you’re entitled to, the system isn’t going to tap you on the shoulder and offer a refund.

The “Black Box” of payroll exists because most HR departments are overwhelmed. They are navigating the transition from the old Finance Acts to the robust, albeit complex, Nigeria Tax Act 2026. If their software hasn’t been perfectly calibrated to the new progressive brackets or the specific nuances of the 2026 reliefs, the error doesn’t favor you. It favors the tax man.

The Math of Invisibility: How ₦15k Becomes ₦1 Million

Let’s get into the numbers. I promise to keep this painless, but we need to see the “hidden math” to understand the stakes.

Imagine a mid-level professional, let’s call him Tunde, earning ₦500,000 per month. That’s an annual gross of ₦6,000,000.

Under the previous regime, Tunde’s tax was relatively straightforward, but under the 2026 framework, the math has shifted significantly:

- The Threshold: The first ₦800,000 of his annual income is now 100% tax-free.

- Progressive Bands: After that, his income is taxed in “steps,” starting from 15% and moving up to 25% for higher portions.

- Statutory Deductions: His 8% Pension contribution and any National Housing Fund (NHF) payments must be deducted before tax is calculated.

Now, here is where the “leak” happens. If Tunde’s payroll system fails to account for a single relief, such as the newly introduced Rent Relief, or if it calculates his tax based on his full Gross Income instead of his “Taxable Income,” he could easily be overcharged by ₦15,000 a month.

₦15,000 feels like a “subscription fee.” It’s the cost of a few nice meals or a data bundle. You might not even notice it’s gone. But let’s look at the “System View”:

- 1 Year: ₦180,000

- 5 Years: ₦900,000

In five years, Tunde has “gifted” the government nearly one million Naira simply because he didn’t see the math. Most professionals would spend weeks preparing for a performance review to negotiate a ₦180,000 annual raise. Yet, they lose that exact amount through invisibility.

The 2026 Shake-up: What You’re Probably Missing

The Nigeria Tax Act 2026 isn’t just a document; it’s a total reimagining of how the state collects revenue from individuals. While the headlines focused on the ₦800,000 tax-free threshold, the real “devil” (and the real opportunity) is in the details of the reliefs.

The Death of the CRA

For years, the Consolidated Relief Allowance (CRA) was the “default” relief for every Nigerian worker. It was easy and automatic. It is now gone. The 2026 Act abolished the CRA in favor of more “targeted” reliefs. If your payroll officer is still hitting the “CRA” button on their Excel sheet, your tax filing is technically non-compliant, and you might be overpaying (or setting yourself up for an audit).

The New Rent Relief Hero

The 2026 Act introduced a specific Rent Relief. You can now deduct the lower of ₦500,000 or 20% of your annual rent from your taxable income.

- The Catch: This isn’t automatic. You have to provide proof of payment or a valid lease agreement to your employer.

- The Reality: Most people are too busy to “bother” with the paperwork, effectively choosing to pay 20% more tax on that portion of their income.

The Life Insurance & Mortgage Shield

In an effort to encourage long-term financial stability, the government has made life insurance premiums and mortgage interest fully deductible. For a detailed breakdown of these specific sections, the PwC Nigeria Tax Centre remains one of the best external authorities for deep-diving into the legal text.

The Psychological Asset: Clarity Over Anxiety

We talk a lot about the financial cost of tax ignorance, but the psychological cost is just as heavy.

When you don’t understand your deductions, you subconsciously treat your income as “unreliable.” You start living defensively. Have you ever hesitated to move to a better apartment, start a side project, or commit to a long-term investment because you weren’t “sure” if you could afford it, even though your salary says you can?

That hesitation is tax anxiety.

When you operate in the dark, you oversave out of fear and underspend on growth. However, when you have transparency, your behavior shifts:

- Confidence: You know that your ₦420,000 net pay is “true” money.

- Predictability: You can project your savings for the next 12 months with 100% accuracy.

- Risk Management: You stop worrying about “surprises” from the tax authorities.

Peace of mind is not just an emotion; in the world of finance, it’s a high-performing asset. It allows you to move from being a “hustler” (always reacting to the next bill) to being a “systems thinker” (proactively directing your cash flow).

Why Transparency Beats ‘The Hustle’

We live in a “hustle” culture. We are told that the answer to every money problem is to make more.

- “Need more money? Get a side gig.”

- “Inflation hitting hard? Work more hours.”

While increasing income is great, it’s only half the battle. If your “reservoir” (your bank account) has a hole in the bottom called “Tax Leakage,” pouring more water in won’t solve the problem. You’ll just get tired faster.

Transparency is the act of plugging the hole. It is the realization that a Naira saved in tax is worth more than a Naira earned in salary. Why? Because you didn’t have to trade any extra time for that tax-saved Naira. It’s “free” money that was already yours.

From Passive Compliance to Informed Control

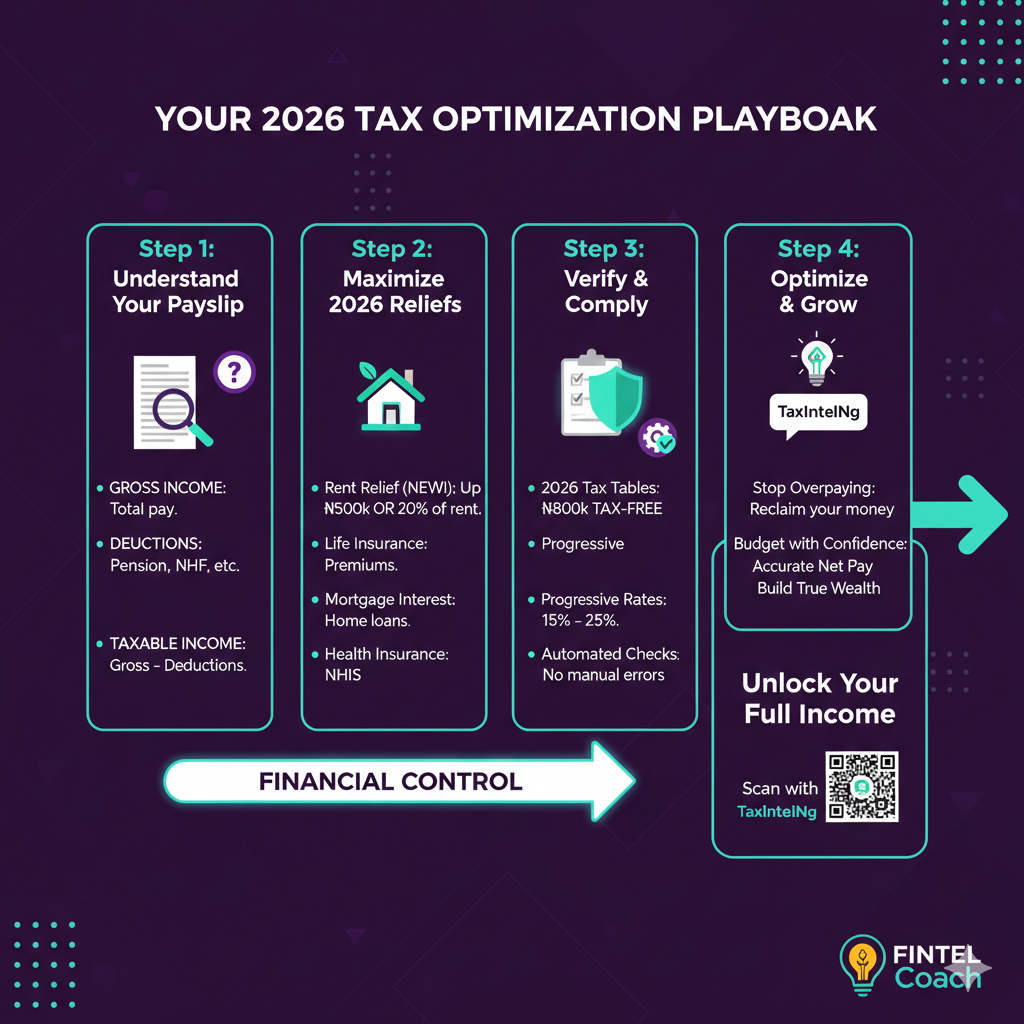

The goal here isn’t to become a tax lawyer. You don’t need to spend your weekends reading the Official Gazette of the Federal Republic of Nigeria. You just need to move from Passive Compliance to Informed Control.

In 2026, information is no longer just “nice to have.” It is the difference between those who feel squeezed by the economy and those who find ways to thrive within it. When tax becomes transparent, it stops being a “mysterious thief” and starts being a known, manageable variable.

The Final Reflection

Ask yourself these three questions:

- Can I explain exactly how my ₦500k gross becomes my ₦400k net?

- Did I claim my Rent Relief for the 2026 tax year?

- Am I 100% sure my employer isn’t still using 2025 tax tables?

If the answer to any of these is “I don’t know,” then your money is in a black box. And black boxes always leak.

Introducing a Better Way: TaxIntelNg

We believe that no professional should lose their hard-earned money to “hidden math.” That is why, as part of TaxIntelNg Launch Week, we are bringing the light to the black box.

TaxIntelNg is designed to be the “brain” for your personal taxes. It doesn’t just calculate numbers; it identifies the specific reliefs you are missing and optimizes your take-home pay based on the Nigeria Tax Act 2026.

The official launch is Saturday, 14th February 2026.

To celebrate our launch, we are offering free Tax Health Checks for the first 100 users. This is your chance to audit your current payslip and see exactly where your leakages are.

👉 Click here to join the waitlist and start optimizing your income today

Clarity is not optional in 2026. It is leverage. Don’t leave your money on the table.